Bank of America Points Review: Everything You Need to Know

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

INSIDER SECRET: If you hold the Bank of America®️ Premium Rewards®️ credit card, you are always better off redeeming your points for cash than to reimburse travel. That’s because you can simply pay for the travel with your credit card, EARN POINTS for your purchase, and use the cash back to cover the cost!Although Chase, Amex, and Citi typically get most of the spotlight, it’s important not to overlook other bank currencies such as Bank of America Points. Continuing our series on “Everything you need to know…”, I wanted to highlight the Bank of America points program—including earning, redeeming, and everything in between.

Bank of America offers both a points program and a cashback program. They’re similar in some ways, but overall separate—so keep that in mind. As the second largest bank in the US, Bank of America already services many folks’ financial needs. And there is most certainly value in simplicity, even if your points earning isn’t as high as it is with other banks.

So without further ado, here’s our full Bank of America points review!

Bank of America Points Review

How to Earn Bank of America Points

The best ways to earn Bank of America points are by signing-up for new credit cards, using your Bank of America credit cards for everyday spending, and shopping through the Bank of America Travel Center.

Signing-Up for Bank of America Cards

Per usual in the miles & points hobby, free travel comes the fastest by signing-up for a new credit card that offers a valuable intro bonus. You can always find the listing of our current, favorite credit card offers here.

But I’ll highlight a few limited-time offers that might be interesting. For example, I love the Bank of America Premium Rewards due to its solid earning on travel and dining, as well as an annual $100 travel credit. Plus, it comes with 50,000 points (worth $500 in travel credits or cash) after spending $3,000 on purchases within the first 90 days of account opening—a quick opportunity to pad your travel budget!

For more information on this card (and how to leverage your overall Bank of America relationship to earn more points!), check out our full review of the Bank of America Premium Rewards credit card.

Or if you prefer a no annual fee credit card you’ve got the following options:

- Bank of America® Travel Rewards credit card – 25,000 points (worth $250 in statement credit toward travel purchases) after spending $1,000 on purchases in the first 90 days of account opening

- Bank of America® Business Advantage Travel Rewards World Mastercard® credit card – 30,000 points (worth $300 in statement credit toward travel purchases) after spending $3,000 on purchases in the first 90 days of account opening

Everyday Spending on your Bank of America Credit Cards

Once you have a points-earning Bank of America credit card, you can rack up thousands of miles each month by making regular purchases on your cards. With a bit of strategy, you can double or even triple your points accumulation by using the right card for the right purchases—such as by using the Bank of America Premium Rewards for 2 points per dollar on all dining purchases.

Book Travel Through the Bank of America Online Travel Portal

Additionally, you can shop through the Bank of America Travel Center to earn 3 points per dollar on flights, hotels, car rentals, cruises, and more. This seems like a great value (after all, triple points!)—but you might get a better return by shopping through a different bank’s travel portal or by using a different credit card. Always do the math and decide what the best option is for you!

It’s also worth noting you’ll be charged a fee for changes to your travel reservations in addition to the change fees charged by the airline, hotel, etc.

- $30 charge for changes to airfare

- $10 charge for changes to hotel

- $10 charge for changes to rental car

Bank of America Preferred Rewards

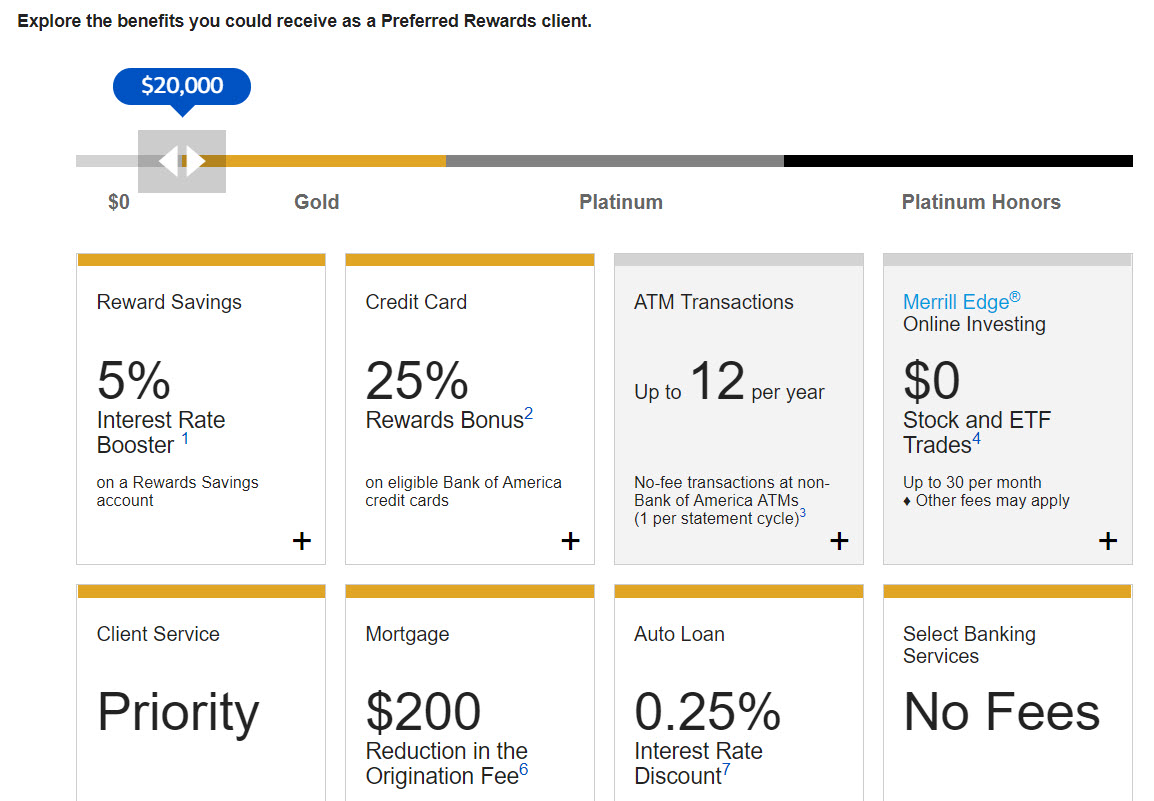

Perhaps the primary advantage of the Bank of America points program (and how you’ll get significant value) is through the Bank of America Preferred Rewards program. Bank of America Preferred Rewards is a loyalty program for Bank of America and Merrill Edge (Bank of America’s affiliate investment company) customers that provides benefits based on a tier level.

Bank of America Preferred Rewards includes other benefits (such as free ATM fee reimbursement), but we’re most interested in the rewards bonuses for spending. The bonus you receive depends on the balance in your Bank of America account:

- $20,000 to < $50,000 – 25% bonus

- $50,000 to < $100,000 – 50% bonus

- $100,000+ – 75% bonus

This means that instead of earning 3 points per dollar for purchases through the online travel portal, Gold members would earn 3.75 points, Platinum members 4.5 points, and Platinum Honors members 5.25 points. That’s an awesome return on your travel spending!

As you can see, the Bank of America Preferred Rewards program can be a game changer for anyone earning Bank of America points—as the percentage boost can greatly accelerate your earning. And because the combined balances requirement can be met with retirement or investment accounts as well, they might be within reach for you or your family!

How Much are Bank of America Points Worth

Unfortunately, the biggest downfall (and a rather significant consideration!) to Bank of America Points is their low value of up to one cent per point—assuming you redeem them for travel credits/reimbursements (or cash if you hold the premium credit card).

If you choose to redeem your points for cash back with the Bank of America Travel Rewards or the Bank of America Business Advantage Travel Rewards (in the form of a statement credit), your points are worth even less (0.6 cents each)! With the Bank of America Premium Rewards, you’ll receive 1 cent per point for cashback.

This means that in order to maximize your points value, you need to either have some travel purchases or carry the Bank of America Premium Rewards. Fortunately, Bank of America is very flexible with what they consider “travel” — including the basics (flights, hotels, rental cars, etc.) as well as some more obscure options including amusement parks, art galleries, zoos, circuses, and more! This is a great benefit for families hoping to “wipe out” a large family vacation to Disneyland, for example.

Although I don’t recommend it, you can also redeem Bank of America points for gift cards or statement credits (without “reimbursing” a travel expense. When redeeming your points for gift cards, you’ll only get ~0.7 cents per point at the low end and 1 cent per point at the high end. The more points you redeem for gift cards, the more value you’ll get. For example, if you redeem 25,000 points, you’ll receive a $250 gift card.

As discussed above, this makes Bank of America points considerably less valuable than those of their competitors, such as Chase Ultimate Rewards, American Express Membership Rewards, Citi Thank You Points, and Capital One Miles. On the other hand, the consistency in the points value makes for easy accounting and simple strategies, as I’ll discuss below.

How to Use or Redeem Bank of America Points

Because Bank of America points are typically worth ~1 cent each (for cash with the premium card, or travel credits with the others)—redeeming is very simple. To view your points balance, simply log-in to the Bank of America website to view your credit cards. Then select the “Rewards” tab to view your “Total Available Points.” Here, you can view your pending, earned, and redeemed points amounts (to make sure your accounting is accurate!).

Click on “Redeem Points” in order to select how you want to redeem your points–whether for cash or to offset a travel purchase. There is a minimum redemption amount of 2,500 points (the equivalent of a $25 travel purchase), so be sure you have at least that many points before trying to redeem them.

Pro Tip: If you hold the Bank of America Premium Rewards, you are always better off redeeming your points for cash than to reimburse travel. That’s because you can simply pay for the travel with your credit card, earn the points for your purchase, and use the cash back to cover the cost!Do Bank of America Points Expire?

Thankfully, Bank of America points don’t expire (unless you close your cards!) —a definitive plus when considering their overall value. Even if you don’t use your credit card for months, your points are safe and you can redeem them or use them without worry so long as your account is in good standing.

Downsides of the Bank of America Points Program

Even though Bank of America points are easy to accumulate, simple to redeem, and never expire—the inability to transfer points and the maximum of 1 cent per point in value severely limits the upside of these points. Any feature or benefit of the points program will continue to be overshadowed until Bank of America increases the points value or allows them to be transferred to various travel partners.

Additionally, I would prefer for all points to be easily redeemable for cash—as opposed to requiring a travel purchase to be offset. For my personal uses, this isn’t a problem because I regularly have travel expenses that I can reimburse. But for the average user, Bank of America could win some serious points (pun intended!) by making points redemptions to cash or statement credit a quick and simple 1 cent per point process.

Bottom Line

The Bank of America points program doesn’t top my list of favorites—but it has unique values nonetheless.

Yes, you might get more points value from everyday spending when leveraging a combination of Chase credit cards with rotating quarterly categories that you strategically redeem with optimal travel partners. But Bank of America’s simplicity of earning and redeeming points is actually a significant benefit for folks looking to have a single, simplified points strategy (or for folks who have exhausted applications with the other large card issuers!). This is especially true if you can benefit from the Bank of America Preferred Rewards program–which greatly improves your points earning potential.

My personal points earning and redeeming strategy includes always keeping a stash of “cash-equivalent” points that I can use to offset unique travel expenses. This means that in addition to Barclays Arrival Points and Capital One Venture miles, I like to have a healthy balance of Bank of America points I can use to offset miscellaneous travel purchases at any time.

Let me know your thoughts in the comments! And subscribe to our newsletter for more informative miles & points post like this in the future.

Updated on 2/10/20

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!